The tax break on what, losing money on it as an operating business?ousdahl wrote: ↑Tue Jun 15, 2021 2:32 pmI think my gripe is a more specific one.twocoach wrote: ↑Tue Jun 15, 2021 2:26 pmWhat specifically do you think this gives them the ability to "write off"? Write off from what? If you buy a house for $500,000 in cash you dont get to avoid paying income tax on that $500,000. Frankly, you lose the ability to write off the mortgage interest since there isn't a mortgage. Not sure what it is that you think this does.

It’s the rich dudes buying, for instance, a whole ranch for them to go vacation on, and establishing or maintaining a cattle operation, or a logging operation, or whatever, for no reason other than to get the tax break.

Strikes

Re: Strikes

Re: Strikes

I'd have a lot more spending money if I was taxed at the same rate as Bezo's dividends. Maybe not enough to buy $165 million dollar house in Beverly Hills, or the $80 million he dropped on 3 Manhattan apartments, but I think it's fucked up that my modest income is taxed at a higher rate than the dividends (or other sources of money akin to an income) that he makes that dwarf my income which top out at 20%.BasketballJayhawk wrote: ↑Tue Jun 15, 2021 2:42 pmCorporation income does not pass thru to personal income tax returns is all i am saying. If an individual only owns corporations and doesn't pay himself a salary or have other income (w2, s corp, partnership, sch C businesses, Sch E rental properties, capital gains, interest/dividend income, etc), then they won't show any income on personal returns.PhDhawk wrote: ↑Tue Jun 15, 2021 2:38 pmwhat about them?BasketballJayhawk wrote: ↑Tue Jun 15, 2021 2:34 pm

Personal income taxes.

What about his corporation(s)?

He's the wealthiest INDIVIDUAL on the planet.

Oh, and if we're talking percentages, his corporations are taxed at a lower percentage than my income (at least for the past several years)

Your last point about % is a relevant and real topic for discussion.

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

-

Deleted User 863

Re: Strikes

And i think that your stance is a reasonable position to have....one that i would say i agree with.PhDhawk wrote: ↑Tue Jun 15, 2021 2:52 pmI'd have a lot more spending money if I was taxed at the same rate as Bezo's dividends. Maybe not enough to buy $165 million dollar house in Beverly Hills, or the $80 million he dropped on 3 Manhattan apartments, but I think it's fucked up that my modest income is taxed at a higher rate than the dividends (or other sources of money akin to an income) that he makes that dwarf my income which top out at 20%.BasketballJayhawk wrote: ↑Tue Jun 15, 2021 2:42 pmCorporation income does not pass thru to personal income tax returns is all i am saying. If an individual only owns corporations and doesn't pay himself a salary or have other income (w2, s corp, partnership, sch C businesses, Sch E rental properties, capital gains, interest/dividend income, etc), then they won't show any income on personal returns.

Your last point about % is a relevant and real topic for discussion.

-

Deleted User 863

Re: Strikes

Exactly. These scenarios don't make sense.twocoach wrote: ↑Tue Jun 15, 2021 2:50 pmThe tax break on what, losing money on it as an operating business?ousdahl wrote: ↑Tue Jun 15, 2021 2:32 pmI think my gripe is a more specific one.twocoach wrote: ↑Tue Jun 15, 2021 2:26 pm

What specifically do you think this gives them the ability to "write off"? Write off from what? If you buy a house for $500,000 in cash you dont get to avoid paying income tax on that $500,000. Frankly, you lose the ability to write off the mortgage interest since there isn't a mortgage. Not sure what it is that you think this does.

It’s the rich dudes buying, for instance, a whole ranch for them to go vacation on, and establishing or maintaining a cattle operation, or a logging operation, or whatever, for no reason other than to get the tax break.

His heart is in the right place...and i talk shit to him but i think ousdahl is a nice genuine dude who i am sure i could hang out with in real life and get along with (even if we disagreed on things).

Re: Strikes

I would like to see both that and the corporate tax rates be raised slightly. Biden wanted to raise the corporate rate from 21% to 28% but offered to compromise at 25% as part of his Infrastructure Bill. It would be nice to see dividend taxation bumped up to match it.PhDhawk wrote: ↑Tue Jun 15, 2021 2:52 pmI'd have a lot more spending money if I was taxed at the same rate as Bezo's dividends. Maybe not enough to buy $165 million dollar house in Beverly Hills, or the $80 million he dropped on 3 Manhattan apartments, but I think it's fucked up that my modest income is taxed at a higher rate than the dividends (or other sources of money akin to an income) that he makes that dwarf my income which top out at 20%.BasketballJayhawk wrote: ↑Tue Jun 15, 2021 2:42 pmCorporation income does not pass thru to personal income tax returns is all i am saying. If an individual only owns corporations and doesn't pay himself a salary or have other income (w2, s corp, partnership, sch C businesses, Sch E rental properties, capital gains, interest/dividend income, etc), then they won't show any income on personal returns.

Your last point about % is a relevant and real topic for discussion.

Re: Strikes

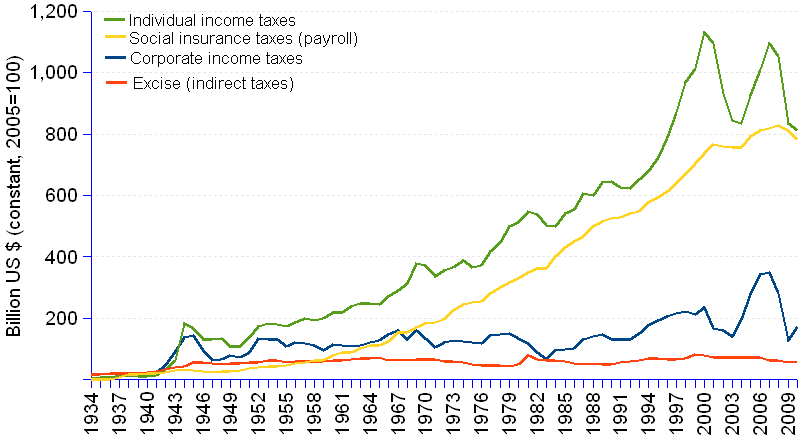

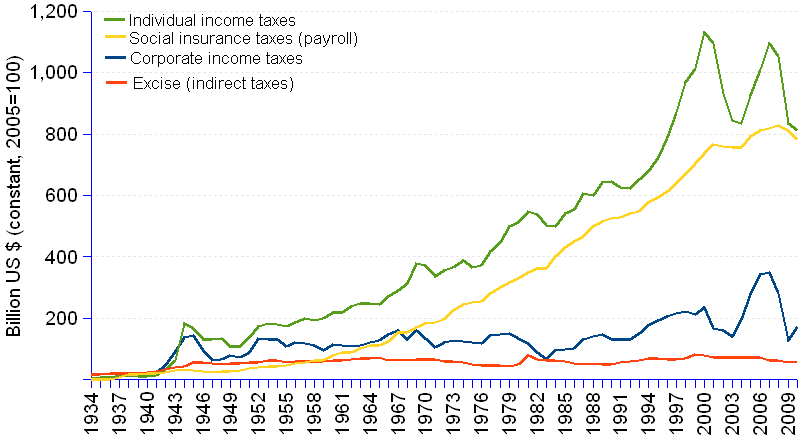

Illy you seem to really want to defend the super wealthy for paying SO MUCH in corporate taxes, but here is the breakdown of US tas revenue from 2019 and the trend over the past several decades:

I'm not interested in re-distribution of wealth, or penalizing billionaires, I just want things to be more fair. Bezos and Buffett and Musk drive on the same streets and sidewalks and are protected by the same military as I am.

I'm not interested in re-distribution of wealth, or penalizing billionaires, I just want things to be more fair. Bezos and Buffett and Musk drive on the same streets and sidewalks and are protected by the same military as I am.

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

-

Deleted User 863

Re: Strikes

I am not defending the super wealthy, nor am did i claim they pay "so much" (whatever that would mean) in comparison to the other segments of where total tax dollars come from....all i did was point out that not everything is tied to your adjusted gross income on your personal (individual) tax returns, so that can sometimes be misleading.PhDhawk wrote: ↑Tue Jun 15, 2021 3:06 pm Illy you seem to really want to defend the super wealthy for paying SO MUCH in corporate taxes, but here is the breakdown of US tas revenue from 2019 and the trend over the past several decades:

I'm not interested in re-distribution of wealth, or penalizing billionaires, I just want things to be more fair. Bezos and Buffett and Musk drive on the same streets and sidewalks and are protected by the same military as I am.

Re: Strikes

saw that on reddit.

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

Re: Strikes

what’s my Reddit handle, anyway?

Re: Strikes

Also, good luck getting a mortgage with 10% down.

AND...wtf jobs do millenials have in the northern plains that pay so well...I guess those are adjusted dollar amounts?

Also, if you were 44 in 2016 you are not a millennial.

AND...wtf jobs do millenials have in the northern plains that pay so well...I guess those are adjusted dollar amounts?

Also, if you were 44 in 2016 you are not a millennial.

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

Re: Strikes

So, the dollar amounts in the two are not the same, one is in real dollars and one is adjusted?

AND...(get off my lawn post, but) if the point of the post is that milennials aren't paid enough to buy a home, shouldn't we not be looking at the average price of a house, and instead be looking at the average price of a FIRST house? One of the reasons that someone a little older might be able to afford a more expensive house isn't just a higher salary, but also because they could probably sell their first house at a profit, which would be a large down payment, reducing the mortgage and therefore the payments?

AND...(get off my lawn post, but) if the point of the post is that milennials aren't paid enough to buy a home, shouldn't we not be looking at the average price of a house, and instead be looking at the average price of a FIRST house? One of the reasons that someone a little older might be able to afford a more expensive house isn't just a higher salary, but also because they could probably sell their first house at a profit, which would be a large down payment, reducing the mortgage and therefore the payments?

Last edited by PhDhawk on Tue Jun 15, 2021 4:06 pm, edited 1 time in total.

I only came to kick some ass...

Rock the fucking house and kick some ass.

Rock the fucking house and kick some ass.

Re: Strikes

And good points.

Kinda blows my mind that CO is the second most expensive market

Kinda blows my mind that CO is the second most expensive market

Re: Strikes

Oil fields, pay is insane. Like $80/ghr to drive a water truck. Lots of them work 2 weeks on (at 12-15 hr days) 1 week or 2 off. Tons of OT (which is horrible for taxes but great for total income in a diagram like this).

Predictably, it has become nearly impossible to house these workers. 10 to a house all paying $2000 a month for a shithole. $10 beers, etc. Its a misleading statistic. BUT, I know a few guys that have gone out there, been smart about it and made a killing.

Just Ledoux it

Re: Strikes

Why would Bezos' dividends not be taxed as regular income? Mine certainly are. I thought it was just the long term capital gains from selling something that were taxed lower?

I guess I could look it up, but given it was mentioned here I am guessing someone already knows.

I guess I could look it up, but given it was mentioned here I am guessing someone already knows.

Re: Strikes

That’s a good question - why use average and not median?

genuinely asking

genuinely asking

Re: Strikes

You mean why should average not be used? Because the meaningful thing here is what these numbers indicate for most people, which average is not good at when it comes to income. Better explanation here:https://blog.datawrapper.de/weekly-chart-income/