DCHawk1 wrote: ↑Tue May 09, 2023 10:04 am

pdub wrote: ↑Tue May 09, 2023 9:53 am

Then maybe detract this comment:

"The fact of the matter is that the "ultra-rich" are mostly a figment of your imagination and the "ultra-rich who don't pay their fair share" are entirely fictional."

And this one too actually because we don't need to do that ( see below )*. We can get more money taxing the upper class ( in all forms of wealth ) than we can taxing the middle class:

"If we, as a nation, want to continue to spend as we do on guns AND butter, we will have to be honest with ourselves and raise taxes on the middle class and the working poor. You can't have a European social welfare state without European tax rates (and European economic growth rates)."

This is mostly ok-ish:

"The idea that there is this goose out there, somewhere laying golden eggs, and all we need to do is to catch it and tax those eggs properly is rube-bait disinformation that has circulated (unsubstantiated) for 2 centuries."

*sticking to your guns AND butter comment...but of course, another method of cutting government deficit is shifting what and where is spent around - i.e. I dunno, maybe don't spend around half of the budget on the military.

"Then maybe detract this comment:"

No.

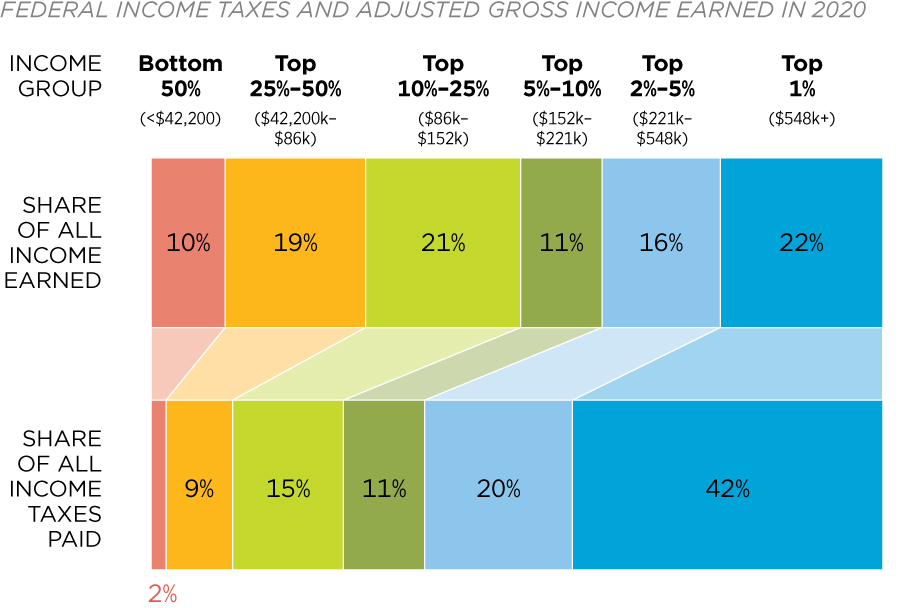

"We can get more money taxing the upper class ( in all forms of wealth ) than we can taxing the middle class"

False. Just because you want something to be true doesn't make it so.

"I dunno, maybe don't spend around half of the budget on the military."

OK. I never said you couldn't/shouldn't. But understand two things: first, that's a surrender on Ukraine. And second, the major spending issue going forward is (mandatory and off-budget) entitlement spending, not defense.

"No"

Well then that's your issue.

You have a gigantic hole in your argument because that is not fictitious.

See above posts from JFish, PhD, me.

They do not pay their fair share. The ultra wealthy are not fictitious.

"False. Just because you want something to be true doesn't make it so."

The wealth of the top 1% increased by $6.5 trillion last year.

Increasing ( or cutting off loopholes ) the taxes on gains for the wealthy AND increasing the income tax for the wealthy would earn you more money than taxing the middle class the same %.*

"first, that's a surrender on Ukraine. And second, the major spending issue going forward is (mandatory and off-budget) entitlement spending, not defense."

Sigh.

If you don't spend half your budget on the military, then that's a surrender on Ukraine.

Second, change the law.

*Of course, reasonable politicians/our leaders, would find that years were gains were less/slim, then budget spending also would have to be slim.