Page 37 of 94

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 7:17 am

by dolomite

Overlander wrote: ↑Mon May 08, 2023 11:31 pm

PhDhawk wrote: ↑Mon May 08, 2023 10:55 pm

Really? In a thread where you're praising a guy as a savior for wanting to collect the nickels and dimes of overpaid gov't employees, you're also going to act like billionaires paying 8.2% effective income tax rates is a meaningless drop in the bucket?

Also, why am I paying 37% ?

Why, you ask are you paying 37%? Maybe you need a smarter tax accountant.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 7:28 am

by DCHawk1

Overlander wrote: ↑Mon May 08, 2023 11:31 pm

PhDhawk wrote: ↑Mon May 08, 2023 10:55 pm

Really? In a thread where you're praising a guy as a savior for wanting to collect the nickels and dimes of overpaid gov't employees, you're also going to act like billionaires paying 8.2% effective income tax rates is a meaningless drop in the bucket?

Also, why am I paying 37% ?

Because you and the Mrs. have taxable income of more than $647,851?

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 7:33 am

by jfish26

DCHawk1 wrote: ↑Tue May 09, 2023 7:08 am

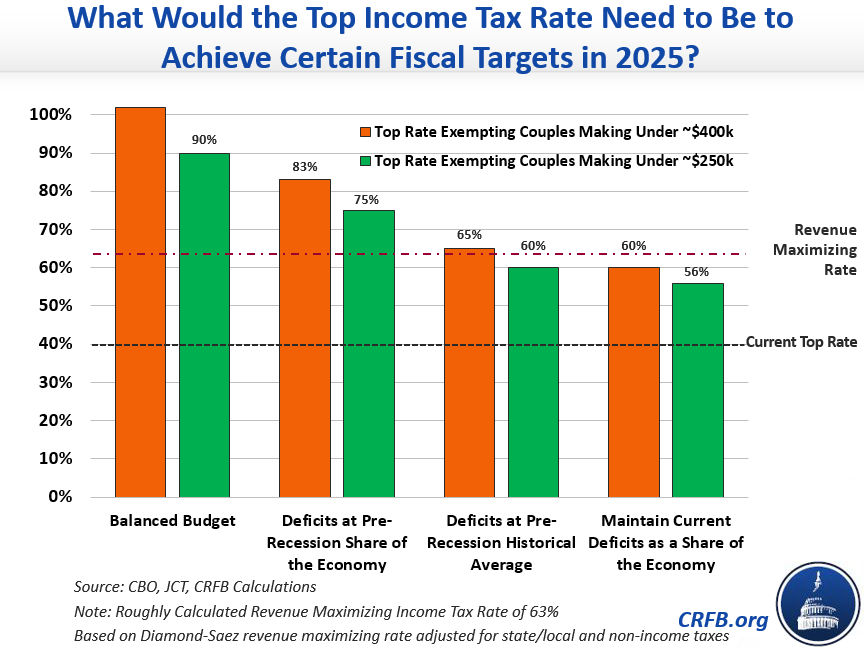

I think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 7:48 am

by DCHawk1

jfish26 wrote: ↑Tue May 09, 2023 7:33 am

I think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

The question is whether they would have a real impact on the fiscal balance sheet. And the answer is, almost certainly, no. In order to do so, at current spending rates, increases would have to start at much lower incomes and be prohibitively high.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 7:49 am

by DCHawk1

And that's a static model that doesn't account for any tax avoidance tactics, etc.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:08 am

by pdub

jfish26 wrote: ↑Tue May 09, 2023 7:33 am

DCHawk1 wrote: ↑Tue May 09, 2023 7:08 am

I think the issue is that, in a saner system, there would be at least two more brackets to the right (or a comprehensive wealth and/or estate tax structure). I personally do not believe that higher tax rates at the far right reaches of the curve would really inhibit growth.

This.

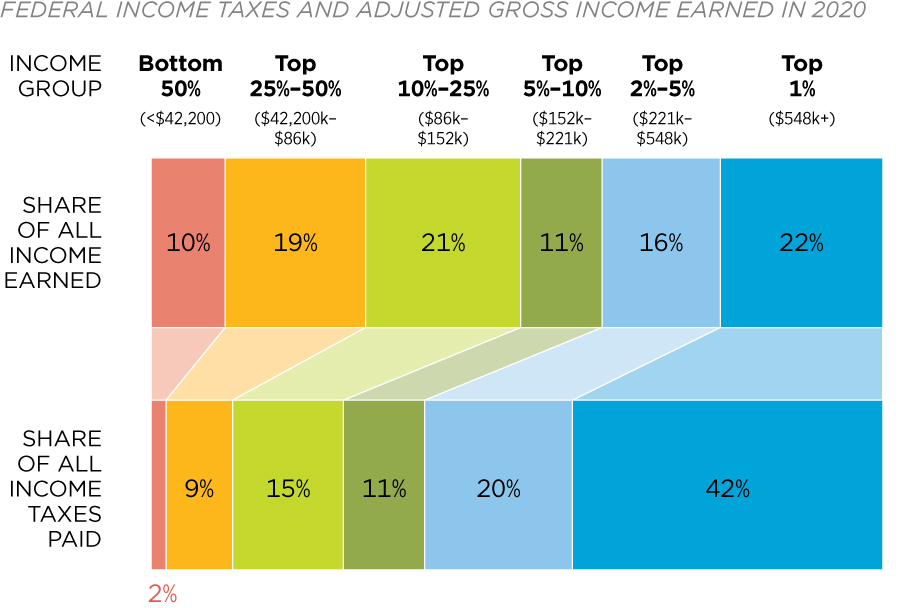

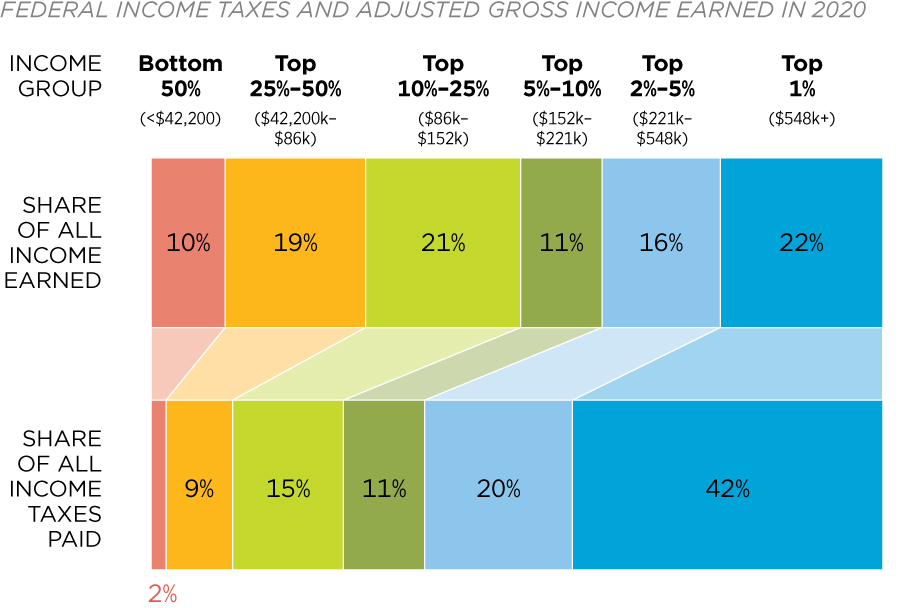

And that would extend that top blue section

There should be no issue whatsoever for the top 1% to be paying more ( well more ) than 50% of the nation's taxes considering the bottom 80% of the entire USA have below 7 percent of the nation's wealth and that the top 1% own more than 1/3rd of the country's wealth.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:13 am

by pdub

In 2020, individual taxpayers paid $1.7 trillion in individual income taxes.

In 2022, the top 1% gained 6.5 trillion in wealth.

Pump the brakes on solving the deficit with just taxes and say, hey, we can BOTH fix the broken tax system AND figure out more responsible spending within our government.

In this case, we're talking about tax distribution.

JFish nailed it on the head with this:

"Trying to address these issues WITHOUT starting at the right end of the wealth curve is like trying to address gun violence WITHOUT starting with access to assault rifles"

And of note, regarding your initial graph:

https://nymag.com/intelligencer/article ... taxes.html

"The first problem with The Stat is that it makes no reference to the proportion of income the rich earn. The juxtaposition between one percent and 40 percent is meant to convey the idea that a small number of people are carrying a gigantic and disproportionate burden, but the figure lacks any context when it omits how much money they earn in the first place."

"Second, and worse still, The Stat ignores the fact that income taxes are just one component of the federal tax system, and federal taxes are just one component of the total tax system...The Stat is technically limited to income taxes for a reason — it’s describing a narrow category of taxation that is especially progressive. But it only works because it makes the listener believe it describes all taxes. The trick works so well it fools the people repeating the stat."

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:19 am

by DCHawk1

Again, that's fine, but it's a political argument, not an economic one.

The tax code is decoupled entirely from spending. It is a conglomeration of political carrots and sticks. It is the means by which politically favored constituencies are rewarded and politically disfavored constituencies are punished.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:22 am

by pdub

DCHawk1 wrote: ↑Tue May 09, 2023 8:19 am

Again, that's fine, but it's a political argument, not an economic one.

The tax code is decoupled entirely from spending. It is a conglomeration of political carrots and sticks. It is the means by which politically favored constituencies are rewarded and politically disfavored constituencies are punished.

Not much argument here in the reality of the inner workings of our political system but i'd argue, at it's roots, it's very much an economical argument as well. There's just all that corrupt bloat ( and that very much includes the very top of the top earners behind the scenes of said political system ) between working theory and those roots.

But still, lowering the tax rate for the bottom 99% and raising it for the top 1%, regardless of minimal impact because of that system, is the correct thing to do, and there's no reason not to be pushing for that. Sitting there and saying "it's all broken we can't do anything" does just that - nothing.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:26 am

by DCHawk1

pdub wrote: ↑Tue May 09, 2023 8:13 am

"Second, and worse still, The Stat ignores the fact that income taxes are just one component of the federal tax system, and federal taxes are just one component of the total tax system...The Stat is technically limited to income taxes for a reason — it’s describing a narrow category of taxation that is especially progressive. But it only works because it makes the listener believe it describes all taxes. The trick works so well it fools the people repeating the stat."

LOL

It is, indeed, limited to income taxes for a reason: because that's the way you measure taxes on income (duh). If you want to get into wealth taxes or capital gains taxes, you get into an entirely different and much more complicated debate -- not to mention one that is even more aggressively politicized. Taxing the "ultra-rich" on wealth or capital gains, while not taxing the not-ultra-rich on the same terms is likely unconstitutional and/or would constitute an effective bill of attainder.

None of this is as simple as "Tax those guys more!"

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:28 am

by pdub

Ah.

Gotchya.

#triggered

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:28 am

by DCHawk1

pdub wrote: ↑Tue May 09, 2023 8:22 am

But still, lowering the tax rate for the bottom 99% and raising it for the top 1%, regardless of minimal impact because of that system, is the correct thing to do, and there's no reason not to be pushing for that. Sitting there and saying "it's all broken we can't do anything" does just that - nothing.

That's political. Period.

Additionally, I have said neither that the system is broken nor that we can't do anything. Yur imagination continues to get the better of you

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:29 am

by DCHawk1

pdub wrote: ↑Tue May 09, 2023 8:28 am

Ah.

Gotchya.

#triggered

You're bad at this.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:30 am

by pdub

DCHawk1 wrote: ↑Tue May 09, 2023 8:29 am

pdub wrote: ↑Tue May 09, 2023 8:28 am

Ah.

Gotchya.

#triggered

You're bad at this.

And you're even worse.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:34 am

by pdub

Of course it is political at it's base because that's where our taxes ( ALL TAXES OMG! ) are theoretically used to run the government.

I think what you're going to try and do here, which is trademark DC, is hunker down in some semantics argument between politics and economics and try and launch what you think are grenades out of your trench when they are actually just balloons full of luke warm air.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:39 am

by pdub

Just clarifying what my particular issue here, that i'm arguing you with over, was this comment:

“…ultra-rich who don't pay their fair share" are entirely fictional.”

This is not fictional.

It is, by most Americans estimates on the distribution of wealth, reality.

But by all means, get down in the semantics trench, say things are unconstitutional when they break/challenge the current way things are, shift the argument to "what is politics and what is economics" ( not particularly helpful to the comment of ultra-rich who don't pay their fair share being fictional ), and lob balloons.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 8:39 am

by Shirley

"Only in a land of widespread stupidity & sad gullibility would the 99% of people who don't make enough money to be affected by a wealth tax vociferously defend the handful of those who do, on the manifestly ridiculous notion that they too will one day be super-rich."

The Heisenberg Report

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 9:26 am

by PhDhawk

"The analysis from OMB and CEA economists estimates that the wealthiest 400 billionaire families in America paid an average of just 8.2 percent of their income—including income from their wealth that goes largely untaxed—in Federal individual income taxes between 2010 and 2018. That’s a lower rate than many ordinary Americans pay."

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 9:29 am

by jfish26

Feral wrote: ↑Tue May 09, 2023 8:39 am

"Only in a land of widespread stupidity & sad gullibility would the 99% of people who don't make enough money to be affected by a wealth tax vociferously defend the handful of those who do, on the manifestly ridiculous notion that they too will one day be super-rich."

The Heisenberg Report

Shit, I don’t think even 50%

of the 1% have a good grasp on what things look like at the very top.

Re: Vivek ramaswamy

Posted: Tue May 09, 2023 9:31 am

by jfish26

PhDhawk wrote: ↑Tue May 09, 2023 9:26 am

"The analysis from OMB and CEA economists estimates that the wealthiest 400 billionaire families in America paid an average of just 8.2 percent of their income—including income from their wealth that goes largely untaxed—in Federal individual income taxes between 2010 and 2018. That’s a lower rate than many ordinary Americans pay."

And in this way, the fact that the top 1% pay 44% of all income tax…demonstrates JUST HOW MUCH wealth is accumulated at the far right end of the curve.